Did you know that 1 in 4 of today’s 20-year-olds will become disabled before they retire? This alarming statistic should make everyone sit up and pay attention. Yet, disability insurance remains an overlooked investment for many. But why is it suddenly gaining traction?

With economic uncertainties and health crises reshaping how we think about job security, disability insurance is taking center stage. More professionals are now realizing its importance as a safety net against the unexpected, ensuring financial stability when life throws a curveball.

A shocking number of workers believe their chances of disability are slim, even though statistics paint a different picture. Many rely solely on savings, ignoring that most savings aren't enough to cover long-term income loss. Furthermore, workplace disability coverage often falls short, leaving gaps in protection that most are unaware of. But that’s not even the wildest part…

Professionals are turning to disability insurance as their job relies heavily on cognitive capabilities, vulnerable to injuries or illness. In such cases, losing the ability to work isn't just a blow to their income; it's often a direct hit to their identity. What happens when the mind, not just the body, needs protection? That’s exactly what disability insurance addresses. But what happens next shocked even the experts…

It might surprise you to learn that more than 37 million Americans, almost 12 percent of the population, are classified as disabled. This number is on the rise, driven by a mix of demographic trends and environmental factors. Not convinced? Consider this: diseases like cancer and heart issues, which aren't always spoken about, can cause long-term disabilities and ruin careers without warning. But what you read next might change how you see this forever.

Interestingly, less than 5% of disabling accidents and illnesses are work-related; the majority occur outside the workplace. Hence, even if your job provides disability insurance, it may not cover these more common occurrences. It’s a loophole workers can no longer afford to ignore. There's more to this story, though, and the next insights will leave you astonished.

The average length of a long-term disability for those who become disabled for 90 days or more is 31.2 months. Imagine being without income for nearly three years. Savings dwindle fast; what seems like a nest egg evaporates under such a prolonged strain. But there’s one more twist you probably weren’t aware of.

Disability insurance isn’t just about worst-case scenarios. It also serves as a protective measure for mental health challenges, stemming from stress or burnout. Professionals in high-stress careers are especially susceptible to these impacts. Understanding this facet can dramatically alter your perspective on insurance's role. But what you discover next is bound to surprise you even more.

Disability insurance is often misunderstood, yet its benefits extend way beyond just financial protection. Did you know that some policies provide rehabilitation benefits, helping you return to work faster and more efficiently? These offerings can include physical therapy, counseling, or even retraining, tailoring to specific job requirements. It's an invaluable service not addressed by other insurance types.

Additionally, disability insurance can cover certain living expenses directly related to your disability, which standard health insurance doesn’t always support. These could be home modifications or specialized transportation needs. Many are unaware of how robust these policies truly are.

Interestingly, these policies can often be customized. This means they can act as a supplementary benefit to enhance existing workplace coverage or fill in gaps left by public insurance programs. This flexibility often comes as a surprise to policyholders, unlocking tailored benefits they didn’t expect.

The tax advantages are yet another often-overlooked aspect. Many disability insurance premiums are tax-deductible if you’re self-employed, reducing your overall taxable income. The potential savings make these policies even more appealing, especially as tax laws evolve. With these strategies, many are finding unexpected financial stability through disability insurance.

Freelancers have been late to the disability insurance party, largely due to misconceptions about personal liability and cost. But as gig economies swell, they're realizing the stark risks of income disruption from illness or injury. Many are waking up to this flyer and prepping, but there's so much more to unpack here.

Without the cushion of employer-provided benefits, freelance workers face unique financial vulnerabilities. Many might not comprehend the magnitude of potential income loss due to unforeseen physical or mental health issues. Disability insurance offers them peace of mind, providing coverage that adapts to an unpredictable income stream.

The self-employed can often choose from a range of policies that align with their specific work risks and financial requirements. This customization, unattainable through traditional employment, puts freelancers in a prime position to tailor protections that government programs miss entirely. Not surprisingly, more freelancers are flocking to these policies for practical reasons.

Another surprising angle is the opportunity for industry-specific insurance calculators. For instance, a graphic designer might prioritize eyesight and hand function, each enlisted within their plan's intricacies. By fine-tuning their policy with a laser focus, these professionals ensure no stone is left unturned in their financial planning strategies.

Being unprepared for a disabling event is not just a financial strain but an emotional burden. This double-edged sword impacts not only the individual but also the family and friends who watch them struggle. The feeling of helplessness can be crippling, ironically, leaving most emotionally unanchored.

There's a misconception that disability is something that only happens due to severe accidents or old age, but what puts the emotional aspect into stark relief is how younger adults, who are more susceptible than ever, suffer from chronic conditions influencing their work capacity. Finances are just part of the fallout, and this holistic distress is often overlooked.

The emotional impacts include feelings of inadequacy and dependency, which erode self-esteem. This can spiral into depression or anxiety, further complicating recovery. These psychological effects resonate far beyond just practical concerns, touching personal and professional lives in profound ways.

Moreover, knowing there’s a safety net empowers individuals to seek preventive health care and adopt lifestyles less conducive to disability. Such assurance is invaluable, offering more control over one's future. The shift in planning and perspective is catalytic, transforming how individuals relate to work and well-being. Experience this life change and grasp your own emotional preparedness.

Stories abound about families on the verge of financial ruin being pulled back by disability insurance. These real-life sagas recount tales of unforeseen disruptions - like a construction worker rendered unable to lift heavy loads, threatening his family's sole income source. The ripple effects were profound, but the tide turned thanks to this safety net.

For many families, disability insurance buys time. It transforms uncertain futures by ensuring your household remains financially secure despite the primary earner's inability to work. This stabilization proves crucial, allowing for a focus on recovery instead of financial despair. However, surprises don’t end there.

Beyond immediate monetary relief, the psychological reassurance of insurance becomes evident. Families can maintain their lifestyle, sidestepping the panic and dramatic belt-tightening that usually follows such events. The peace of mind provided cannot be overstated, offering an emotional buffer during times of crisis.

These stories are reminders that everyone is susceptible to the unpredictable. The comprehensive protection ensures that families can continue to meet their financial commitments, from mortgage payments to children's education, thus preserving both their legacy and future. Many professionals now recognize this profound impact of disability insurance.

While disability insurance is a vital asset, it’s not without its pitfalls. Missteps often occur when policyholders neglect to scrutinize the fine print, missing crucial coverage details. For instance, the definition of "disability" can vary broadly between insurers, affecting claim eligibility significantly.

Common snags include waiting periods before payments commence and coverage restrictions tied to pre-existing conditions. These overlooked elements may lead policyholders to unexpectedly forfeit benefits, a situation rife with frustration and legal entanglements. Being vigilant from the onset is essential.

Even well-informed individuals can inadvertently opt for insufficient benefit amounts or misconstrue benefit duration. It’s vital to align the coverage with your real-world financial needs, a consideration that calls for frequent policy reviews and adjustments. Underestimating required coverage is a mistake seeing a noticeable uptick.

To navigate these obstacles successfully, consulting with an independent advisor can illuminate murky policy nuances, ensuring protection when it’s needed most. Those swift in taking this step often report a greater sense of security, standing ready against unforeseen challenges.

Choosing the right disability insurance policy starts with researching your options. Each insurance provider offers unique features tailored to different needs and budgets. Starting with a solid understanding of what coverage you need, combined with foresight into future possibilities, leads to informed decisions.

Prioritizing insurers with strong reputations for claims satisfaction is a wise first move. Seek out reviews from current and former policyholders, as these firsthand accounts provide insights often missing from standard marketing materials. It’s an investment in peace of mind.

Knowing your budgetary constraints and lifestyle needs allows policymakers to offer the most suitable solutions. Do appointments with agents offer opportunities to delve deeply into varying clauses and implications? Understanding these elements upfront simplifies future interactions.

Finally, it’s crucial to revisit and refresh your policy as life circumstances change—new jobs, expanding families, or medical updates can all necessitate significant adjustments. Flexibility in your coverage not only anchors your safety net but enables it to grow alongside your life’s journey. Understanding this dynamic is paramount.

As we navigate a post-pandemic world, disability insurance becomes even more crucial. The pandemic underscored global vulnerabilities and highlighted the unpredictable nature of health and employment. As economies attempt a recovery, the insurance landscape continues to evolve, reflecting new demands.

The focus on personal health and preventative measures has risen dramatically. People are more conscious than ever of how vulnerable they truly are, prompting a surge in customized, comprehensive insurance plans that offer broader protections. But the evolution doesn’t stop there.

Through technological advancements, the insurance industry is harnessing big data to develop predictive models, enhancing personalized coverage options. This allows for refined risk assessments and more customized terms, aligning with clients' unique needs and occupations, anticipating a wealth of innovation.

The emphasis on mental health, thrust into the spotlight by the pandemic, adds a critical dimension to policies. Companies are increasingly including mental health coverage in their plans, acknowledging its integral role in general health. Enhanced awareness and available options point to a future where disability insurance is not just desirable but indispensable.

Experts consistently emphasize the fundamental importance of weighing your financial and health situation when considering disability insurance. Each individual’s context will dictate what policy details are most crucial, urging a personalized approach to selection and management.

Knowledgeable advisors often highlight the contrast between short-term and long-term disability coverage. Understanding the period of support you need can steer you towards a policy offering optimal assurance aligned with your career trajectory and financial objectives. This guidance is invaluable, setting a proactive foundation.

Emerging trends point towards hybrid policies that combine various coverage forms, enabling a more holistic security package. With options like these, it's easier than ever to match coverage with life’s intricacies, yielding benefits tailored to distinct life stages. The industry’s path forward appears adaptive and responsive.

Experts also urge individuals to revisit their policies regularly. Personal circumstances change, as do the broader economic landscapes and health care advancements, which may necessitate timely updates. Informed policy adjustments ensure ongoing relevance and protection. That’s the hidden wisdom no one talks about.

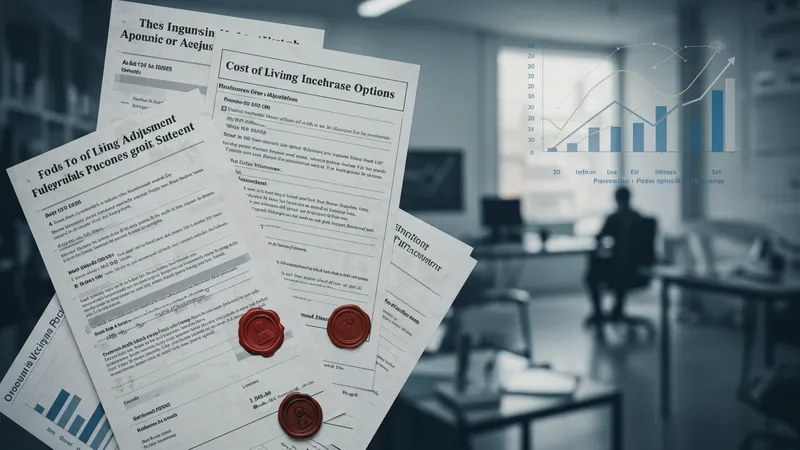

Policy add-ons, or riders, can surprisingly boost your disability insurance’s value, extending coverage beyond traditional confines. Including options like a Cost of Living Adjustment (COLA) rider insulates your benefits from inflation, maintaining purchasing power over years.

Future Purchase Options, enabling additional coverage without health assessments, cater to anticipated income changes. These sturdy protections offer peace of mind, especially in fast-moving or unpredictable career trajectories. Budget accordingly, as these enhancements prove invaluable long-term.

For those with specific health concerns, adding a Critical Illness rider can bridge the gap left by standard policies. This pays a lump sum upon diagnosis, serving as a crucial financial buffer during dire health events. Avoiding tunnel vision is key, ensuring full preparedness.

Inclusion of a Social Security offset rider can also keep out-of-pocket costs down by reducing monthly benefits if you also receive Social Security, thus minimizing overlap. Harnessing these strategic inclusions transforms a basic policy into a robust, comprehensive solution, offering enhanced security.

Unfortunately, common mistakes abound when purchasing disability insurance, often stemming from rushed decisions without thorough research. Misunderstanding policy terms or underestimating coverage needs can leave policyholders vulnerable. The lesson? Take the decision seriously.

A significant error is neglecting to compare providers. Insurers vary widely in policy offerings, customer service, and costs, making contrast crucial for a sound investment. It’s surprising how many professionals skip this fundamental step.

Overlooking policy details, such as benefit period or elimination period, causes future distress when claims arise. Understanding precisely what the plan covers and doesn’t shield policyholders from unpredictable surprises. A missed detail can lead to substantial financial gaps.

Finally, many ignore the opportunity to leverage employer benefits. Group policies, while generous, often fall short, requiring supplementary personal insurance. Recognizing the limitations of workplace plans, and enhancing them accordingly, fortifies financial safety nets, ensuring more comprehensive coverage.

With economic turbulence and health complexities on the rise, disability insurance emerges as an undeniable cornerstone of financial strategy. Adopting a mindful approach towards identifying and securing the right plan is no longer optional.

The protective buffer it provides goes beyond immediate financial relief, influencing overall life quality and mental peace. As we've navigated these pages, the necessity and depth of disability insurance have unraveled. Now, you know why this coverage isn't just beneficial but essential in today's unpredictable world.

So, what will you do with this newfound perspective? Share this article and engage with others in discussion, for every decision today could redefine your personal and financial future. Bookmark it, revisit it, and let it guide your next moves—because what comes next is in your hands, and experts agree: it may just be the smartest step you take.